It was Might 18, 1995, when American financial institution Wells Fargo provided web banking to prospects. That was the primary try of a bodily financial institution to shift on-line. 25 years handed, and 1.9 billion individuals worldwide actively use on-line banking companies, and the quantity goes to succeed in 2.5 billion by 2024.

Table of Contents:

- Mobile Banking App Development

- play store ranking service

- buy android app downloads

- play store app optimization

Looks as if cellular banking growth is one thing of an excellent want within the fintech business. On this article, I am going to dive into this matter, clarify easy methods to create a cellular banking app and why you really need one.

What Is Cellular Banking?

As Wikipedia places it, “cellular banking is a service offered by a financial institution or different monetary establishment that enables its prospects to conduct monetary transactions remotely utilizing a cellular machine resembling a smartphone or pill.” In different phrases, cellular banking is an software you should use for nearly all of the actions you’d do in a bodily financial institution, however now you’ve it in your pocket.

As we found out “what” cellular banking is, let’s transfer to the “why.”

Cellular Banking Advantages

As a Product Supervisor, I at all times steadiness the benefits the product brings to customers and enterprise.

What do I imply right here?

With a cellular banking app, customers will fulfill their want for twenty-four/7 financial institution entry. From the enterprise perspective, creating a cellular banking software offers a aggressive benefit. Since high US banks present on-line banking, you must have one to succeed in these requirements and to not turn out to be an outsider. So the benefits differ, let’s take a better have a look at them.

Advantages For Customers

I’ve talked about 24/7 financial institution entry because the profit for customers, however there are a lot of extra others, test them out:

- 24/7 checking account entry;

- Quick cash switch;

- Quick and safe entry to the account (Face ID, Contact ID);

- Notifications arrange;

- Broader performance;

- Cashback;

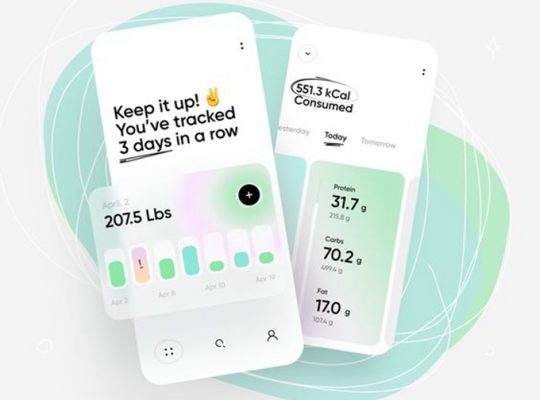

- Consumer-friendly UI design;

- Spending tracker.

Advantages For Enterprise

For those who’re studying this text, likelihood is you realize what advantages cellular banking app growth brings to what you are promoting. However, in case you missed one thing, listed here are some extra:

- Attain extra customers;

- Quicker and simpler growth;

- Simpler A/B testing;

- Extra methods to succeed in out to customers (notifications);

- A greater understanding of consumer habits;

- Greater prospects attraction;

- Extra cautious buyer evaluation and alternative to make the cellular banking software program higher.

How To Create A Cellular Banking App?

Creating a cellular banking software is kind of the identical as creating another product, apart from the safety stage that you must deal with extra. Beneath I described 7 steps of easy methods to develop a web based banking software. Examine them out.

Step 1 – Analysis

At Uptech, we begin with a market evaluation, examine the rivals and the market situations we enter.

In cellular banking growth, I counsel paying critical consideration to the cultural facet, mentality, and consumer habits. For example, once we constructed a banking software for the US market, we discovered that 70% of Individuals have at the least one bank card. So the query of whether or not we must always embody a credit score choice did not even come up. As a substitute, it was a must-to-have characteristic. So, thoughts the cultural facet of the market you are leaping into.

As the results of the analysis step, we get:

- Consumer Persona profile;

- Market evaluation;

- Market share;

- Market habits;

- Worth proposition.

Step 2 – Put together The Safety Base

This step is the one which differentiates cellular banking software growth amongst others. When engaged on cellular banking software program, you need to perceive that it is all about working with delicate consumer knowledge.

That is why here is the safety base you need to thoughts earlier than the event begins:

- Safe password:all passwords should be hashed and solely then saved in a database.

- Auto logout:if customers aren’t lively within the app for greater than quarter-hour, they need to be robotically logged out from the system, each on the front-end and back-end.

- Knowledge privateness:individuals who create a banking app ought to have restricted entry to customers’ tokens, passwords, and different delicate data. All knowledge should be saved in safe platforms like 1Password, Okta, and so forth.

- Safety certificates:within the case of an online app, guarantee you’ve an SSL Certificates, and if it is cellular – SSL Pinning. These docs be sure that all knowledge handed between the Internet server and browser stays personal and safe.

- Safe authentication:Arrange and use fingerprint safety for Android units and Apple KeyChain for iOS.

- Safe card data:implement VGS (Very Good Safety) to show prospects’ card data.

Step 3 – Develop & Check A Prototype

Over my expertise in product administration, I discovered one factor: the product’s success lies within the variety of interactions. Constructing a prototype is one among them.

Consider the prototype as a simplified model of the ultimate product. It ought to embody:

- App logic;

- App construction;

- App design.

Nonetheless, the prototype remains to be a far cry from the ultimate product by way of performance, stability, and aesthetics. It means that you can take a look at your thought. You merely give it to actual customers, collect the suggestions, perceive what works and what’s not, and implement modifications accordingly.

For those who’d ask me, what the easiest way to validate the usability, design, and performance of your cellular banking app is. I would say, with out a shadow of a doubt: “construct a prototype.”

Step 4 – Design UX & UI

Based mostly on the knowledge we gathered through the analysis stage, consumer interviews, and suggestions on the prototype, the design staff roll up the sleeves and begins working.

I discussed earlier {that a} user-friendly UI design is without doubt one of the advantages of cellular banking purposes. That is why you need to work exhausting on it. When individuals cope with something related to their cash, they’ve a worry of doing one thing unsuitable. I do know it from my very own expertise. Each time I apply for a bank card or switch a giant sum of cash, I’m nervous.

That is why ensure you have UX&UI designer who will create a easy, intuitive, and pleasant design. For reference, try our Behance case of the Chase app.

Step 5 – Develop The App

Originally of the event stage, you need to decide the event framework. Issues are fairly clear right here.

For those who’re making a banking software in Android or iOS, I counsel you to go for Native app growth just because it is safer than React Native.

Concerning tech stacks, iOS-based cellular banking apps demand:

- Swift;

- XCode;

- iOS SDK.

For those who’re considering of easy methods to create banking software in Android, then these are instruments of selection:

- Java/Kotlin;

- Android Studio;

- Android SDK.

Step 6 – Combine third Events

Earlier than launching a cellular banking app, there’s another step to move, it is third get together integration. Why do you want one? Utilizing third get together companies could make a extra user-friendly app circulate and retain buyer consideration to the fullest.

Listed here are the commonest third get together suppliers in cellular banking growth particularly:

- A sturdy buyer knowledge analytic device – Phase;

- In-app notifications arrange – Iterable;

- Customers verification device – Onfido;

- A device that connects customers’ monetary accounts to the apps – Plaid;

- In-app messaging device – Sendbird.

When selecting a third get together integration service, essentially the most essential consideration is to test whether it is steady, safe and actively supported.

Step 7 – Launch. Keep. Enhance.

With safety hoops to leap by way of, intuitive consumer circulate to design, and third events to combine, we’re lastly able to launch. That is the excellent news. However banking cellular app growth is not achieved right here.

When your product meets the market, a brand new sequel begins. Customers begin to work together with it, new necessities seem, and you must implement new options. So prepare that your preliminary cellular banking app can change. Generally drastically.

Cellular Banking App Options

It is usually an excellent pleasure to launch the product as quick as doable, nevertheless it’s simple to overlook the important thing cellular banking app options alongside the best way. So right here is the listing of options that took the app from aggressive to fully cutting-edge.

Cellular Banking App Options For The MVP

- Consumer profile;

- Examine account steadiness;

- Transactions historical past;

- Bills dashboard;

- Cash switch;

- Contact and Face ID;

- Integration with Pockets app;

- 24/7 assist;

- Cashback;

- Knowledge encryption;

- Push notifications;

- New card request (digital or bodily).

Notice that the primary characteristic of cellular banking is 24/7 entry. For those who do not fulfill individuals of their have to have the financial institution accessible 24/7, you’ll not win this battle.

Full-Fledged Product Options

Whereas creating an MVP is about fixing the issues with minimal options. When issues come to the full-fledged product, the main focus shifts to the nice-to-have options. Right here’re some you may implement:

- QR code scanner;

- Recurring funds;

- Gamification, rewards;

- Loyalty program from third events;

- ATM & financial institution department areas (if doable).

5 Cellular Banking Growth Challenges

Banking software program growth is a piece with many transferring elements and one nice consumer expertise. Not a straightforward mixture, I need to say. Over my expertise, I’ve confronted a few of these transferring elements. Examine them out beneath, and I hope they’re going to be useful.

Biometric Authentication

I can not stress it sufficient, however cellular banking growth is all about working with delicate knowledge.

After we have been engaged on one fintech challenge and needed to arrange Face and Contact ID authentication, it did not appear a giant deal at first. However once we approached the duty, we confronted points with Android units. So it took us extra time to implement the characteristic.

So thoughts that you just work with delicate customers’ knowledge and take your time.

KYC Verification

KYC (know your buyer) verification is another stumbling block. KYC stands for the method of verifying the identification of financial institution prospects, both earlier than or through the time they begin utilizing your app.

The problem right here is that they are a number of good Threat Analysts. So, you will in all probability want to spend so much of time searching for one. And another helpful integration alloy.com can assist with KYC process.

third Events Integration

At first look, third get together integration does not look like a time-consuming stage. Nevertheless it may very well be a ache, take my phrase.

Often, signing the contracts with third get together suppliers takes extra time than you count on, and it is usually achieved on the final minute. As well as, it might affect the challenge roadmap and delay growth. Builders should work with moked knowledge till the third get together integration is finished, and generally it takes further 1-2 sprints to shut the characteristic.

My recommendation is to put aside a while for third get together integration and plan it beforehand.

Quick Altering Necessities

The event of cellular banking apps requires nice endurance and suppleness. Particularly, for those who work within the US market, the place the fintech business is so fast-growing. It’s important to accommodate new and constantly-shifting necessities and enterprise logic.

Each time I begin to work on the cellular banking app growth, I notice that we’ve to architect the product and its codebase to make sweeping modifications with ease and pace. So prepare for that too.

Authorized Laws

The final problem is authorized laws. To develop a cellular banking app, you must cowl the next requirements.

The final one is – PCI DSS. It maintains and promotes Cost Card Trade requirements for cardholder knowledge security throughout the globe.

Within the US, that may be – CCPA. The California Client Privateness Act is meant to reinforce privateness rights and shopper safety for residents of California, USA.

For those who’re coming into the European market, you need to observe:

- GDPRThe Basic Knowledge Safety Regulation lays down the principles for safeguarding private knowledge within the EU.

- PSD2. The New Cost Providers Directive promotes the event of modern on-line and cellular funds, safer funds, and higher shopper safety throughout the EU and EEA.