Marriage is a really huge duty of the dad and mom and most significantly the bride and the groom. As a result of life will probably be completely modified after the knot is tied between the 2. Don’t fear, I’m not complaining in regards to the two souls! However, the opposite issues which can be very a lot mandatory for dwelling a wholesome and comfortable life. Some couples need children after getting married and a few folks need to take pleasure in their life somewhat extra and plan children there after!

Table of Content

There are a variety of vital issues required for the upbringing of a kid until their marriage. For instance- finance, which is an important constraint. Some persons are wealthy, some are common and a few can’t afford that a lot on their baby’s schooling and different amenities. However each dad or mum needs to present amenities to their baby which they will afford and everybody has the ‘proper to schooling’. Now the time has been modified, there are usually not any monetary obstacles which happen in between the schooling of a kid. All people needs to be educated, whether or not a lady or a boy.

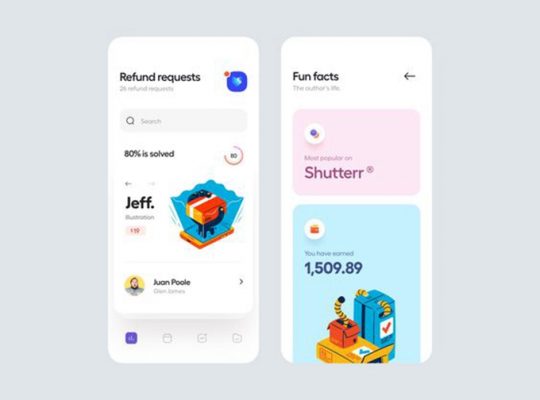

Right this moment, there are a variety of monetary schemes which will help you in managing funds on your baby’s schooling to safe their future. And the expertise has made it less complicated by launching among the apps that make it useful. You possibly can make investments cash proper at your fingertips and safeguard your baby’s future. Certainly one of them is “U-Nest”, which is a simple to make use of cellular app that establishes and manages a tax-free school fund on your baby in minutes.

To start with U-Nest, it is advisable obtain it and set up in your system. You possibly can learn out the affords and make up your thoughts to decide on a plan. You can begin saving on your children with as little as $25 per thirty days. U-Nest is free to obtain and expenses a easy month-to-month payment of $3 per account which will probably be collected by the identical fee technique. The app hyperlinks your checking account to the app and routinely switch cash every month into your baby’s plan.

In line with the specialists, a “529 School Financial savings Plan” is probably the most optimum means to economize for academic bills as a consequence of its tax benefits and funding choices. Regardless of to what revenue group you belongs, U-Nest makes financial savings and investing really easy. Furthermore, it ensures that your cash is invested within the smartest doable means given the age of your baby (and once they count on to wish the cash of their schooling) and the anticipated dangers and returns of shares, bonds, and different funding automobiles.

U-Nest is absolutely secured and registered monetary advisor with the securities and alternate fee and is backed by a staff of skilled monetary specialists and advisors with a long time of expertise. The app has been developed by U-Nest, LLC and is suitable with the newest model of the iOS.

The app is simply versatile, you possibly can examine the account data, how a lot quantity is being invested, and so forth. It picks a customized funding portfolio on your baby based mostly on his/her age and when they’ll want the cash for his or her schooling.

So beginning saving cash by investing in your children’ future now!

PROS: simple to arrange; tax-free development; simple monitoring; easy and quick; reasonably priced; safe app; versatile; makes saving simple to safe a toddler’s future.

CONS: none.